Since announcing a ban on Russian oil imports, President Biden’s advances towards alternative suppliers like Saudi Arabia have been rejected, increasing the likelihood of another energy crisis. If that is the case in the US, it’s easy to understand why the EU isn’t joining the boycott. Expert: “Oil and gas are Putin’s doomsday weapon.”

The suspension of Russian oil and gas supply to the west will create an “economic catastrophe” similar to the energy crisis of the 1970s but the chances of the nightmare scenario materializing are still small given the repercussions for each side.

“Oil and gas are Putin’s doomsday weapon,” says Dr. Amit Mor, CEO of the Eco Energy consulting firm and a lecturer at the Reichman University. Mor compares the potential devastation to Moscow’s nuclear arsenal: “Putin has two powerful tools at his disposal: a nuclear doomsday weapon and an economic doomsday weapon.”

Russia is the world’s second largest oil exporter and supplies 6 out of the 100 million barrels that are consumed each day as well as 40% of Europe’s gas. Even if this amounts to only 5% of the global oil consumption, the US and Europe do not have an alternative source of supply. Saudi Arabia, the only country in the world capable of significantly increasing its output within a short period of time, has declined the US’s pursuits for now amid resentment at President Biden’s refusal to meet with Crown Prince Mohammed bin Salman, inter alia due to his suspected involvement in the murder of journalist Jamal Khashoggi.

Venezuela has also rejected the American advances and Russia opposes a nuclear agreement that would allow the west to buy oil from Iran. North American oil producers require 1-2 years in order to increase their output, with various logistical constraints limiting western countries’ ability to utilize their emergency oil reserves of 1 billion barrels.

“Putin doesn’t have to halt oil exports abroad, just to reduce them by 2-3 million barrels per day and cut gas supply to Europe by ¼-1/3,” Mor says. “The stock markets around the world will consequently crash by 30%-40%, inflation will skyrocket and unemployment will surge, leading to stagflation – which is reminiscent of the energy and economic crisis following the Yom Kippur War and the Arab oil embargo.”

Brent prices hit $128 a barrel this week and Russian Deputy Prime Minister Alexander Novak warned that prices could soar to $300 if Europe joins the US’s boycott. So far only Canada and the UK have backed the US’s oil and gas ban – although all three import relatively small amounts from Russia. In contrast, it supplies 30% of Germany’s oil, 43% of Hungary’s and 23% of the Netherlands’.

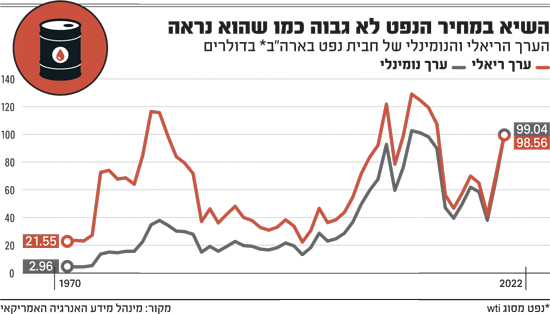

Oil prices have only reached higher levels three times in the past, each culminating in an economic crisis. The first energy crisis came after the 1973 Yom Kippur War due to the decision of six Arab OPEC members to quadruple oil prices to western countries. Oil prices reached a record $37 during the Iran-Iraq War in 1981, equivalent to $116 today.

The record WTI price was set in 2011 at $102 a barrel, equivalent to $128 today. Brent on the other hand, which is sold mainly in Europe (and is used to determine gasoline prices in Israel) reached a peak in July 2008, on the eve of the global credit crisis, of $147 a barrel, equivalent to nearly $200 today.

The price of gas, which in monetary terms constitutes 50% of Russia’ oil exports, is also skyrocketing. Germany receives ½ of its gas from Russia and in some eastern European countries, Russian volumes amount to more than 90%.

Russian gas supply to Europe continues for the time being but concerns about Moscow suspending deliveries or Europe joining the US sanctions have pushed up prices on the side of consumers seeking insurance for the near future.

Gina Cohen, an international expert on gas affairs, believes that the chances of the Russians suspending gas supply are still slim. “Gas brings in €800 million a day to Russia and they have already said they will continue to supply gas to Europe via the pipeline that passes through Ukraine.” She adds that three of the four pipelines that connect Russia to the EU have maintained routine gas supply. One pipeline, which passes through Poland, has switched to non-Russian gas supply.

The EU this week announced a plan to reduce Russian gas imports by 2/3 by the end of 2022 and altogether by 2030. Cohen casts doubt on Europe’s ability to meet this ambitious goal. “The Europeans are trying to buy additional amounts from non-Russian suppliers but most of the LNG is already secured under long-term contracts and the regas facilities in Europe are at near full capacity or suffering from logistical issues. Additional steps, such as reducing heating by 1 degree or increasing the purchase of coal (whose price is already at a peak) will have a limited effect.”

-What if this leads to a gas shortage?

“It would mean the shutdown of factories and a severe blow to the industry. Millions of residents will suffer from extreme cold, inflation, and price hikes.”

The stagflation, a result of an economic slowdown combined with price spikes, underscores the dilemma faced by central banks that were expected to raise the interest rate in order to restrain the prices. The Russian invasion of Ukraine and concerns about a recession make the interest rate hikes even more problematic as they could further deepen the economic slowdown.

Dr. Mor notes that in addition to energy, Russia also exports minerals and precious metals such as bromine, magnesium and diamonds. Ukraine also exports vital raw materials, including 80% of the neon gas used by the global microchip industry.

On Saturday, Putin signed an executive order banning the export of precious metals, which immediately pushed up global metal prices by 30%-60%, including copper and magnesium, and “is due to create huge changes across the chains of supply in the near future,” Mor estimates. The Bloomberg Commodity Index saw its sharpest gain since 1974 this week, inter alia because of a jump in wheat prices. Grain prices have soared by tens of percent following a suspension of exports from Russia and Ukraine, two of the largest grain producers in the world. Neighboring countries have also announced a freeze on exports in preparation for a possible shortage in the local markets.

In Israel, consumers are already feeling the impact of higher bread and baked product prices. The construction inputs index is soaring and the rise in coal prices is expected to lead to a further spike in electricity prices. The inflation rate had exceeded the Bank of Israel’s target even before the invasion to Ukraine began and is now estimated to reach 4% due to imported inflation, or the increase in the price of imported goods.

Another factor that pushes prices up is the shekel rate. The local currency’s strength prevented, or at least restrained, the price rises in 2021 but in recent weeks began to weaken amid the decline of international stock indexes.

If there is a ray of light in any of this, it is Israeli gas: Europe’s gas demands have led to a substantial increase in the volumes Egypt purchases from Israel’s gas reservoirs.

Phone:

Phone: Email:

Email: